At their latest event, Google showcases recent Search updates that could help marketers unlock its full potential.

Google is stepping out of the traditional search box by combining new inputs and developments in computer science. From text searches to phone camera pictures and voice-overs, Google has been optimizing its search engine toward a more natural way of exploring information.

Earlier this year, Google introduced multisearch. By searching images and text simultaneously, multisearch will be available in over 70 new languages in a few months’ time.

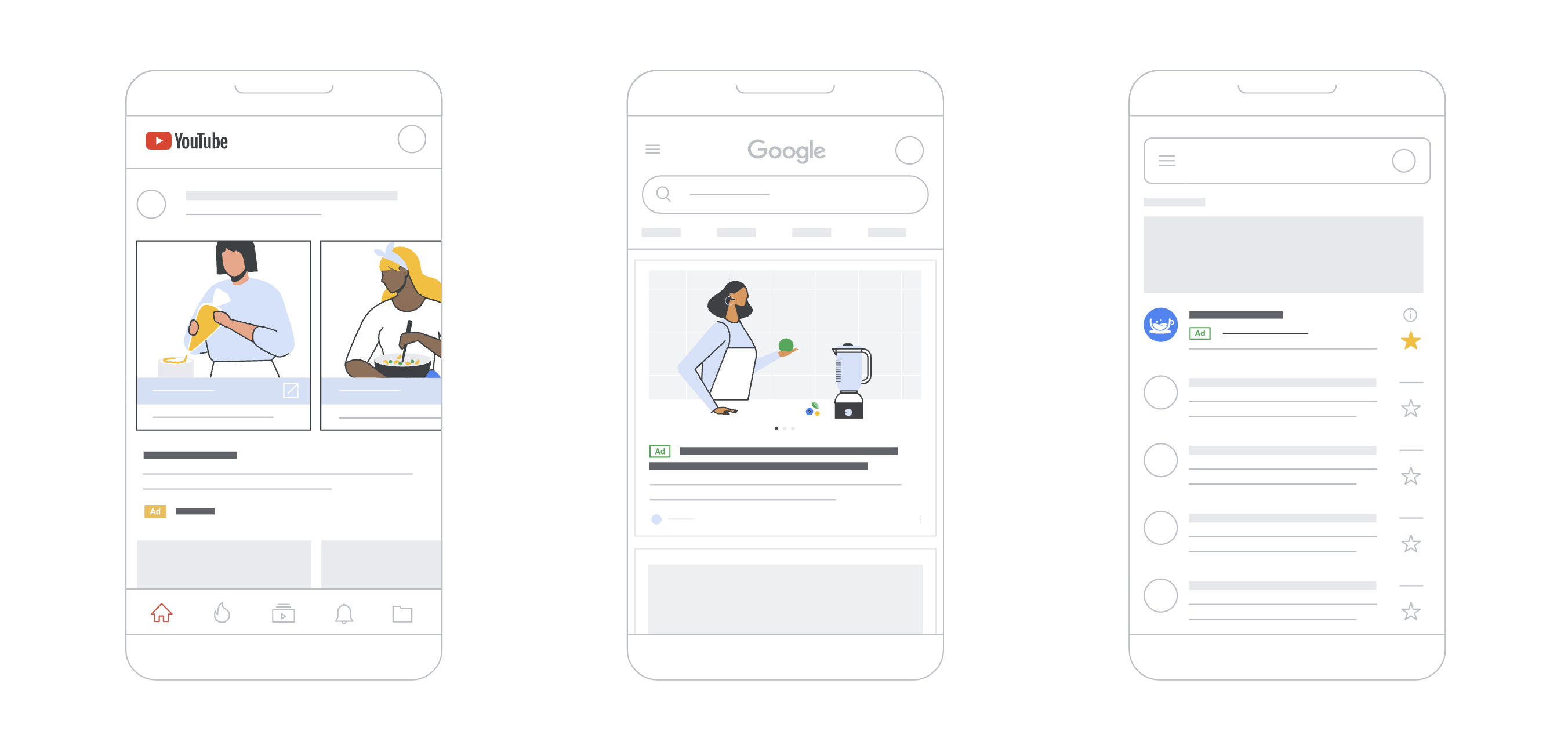

Also, Google intends to make searching a more visual experience. Google Maps will include more immersive capabilities with 3D images using advanced computer vision. This visual approach is beneficial when it comes to shopping, where people are looking for the most accurate display of products.

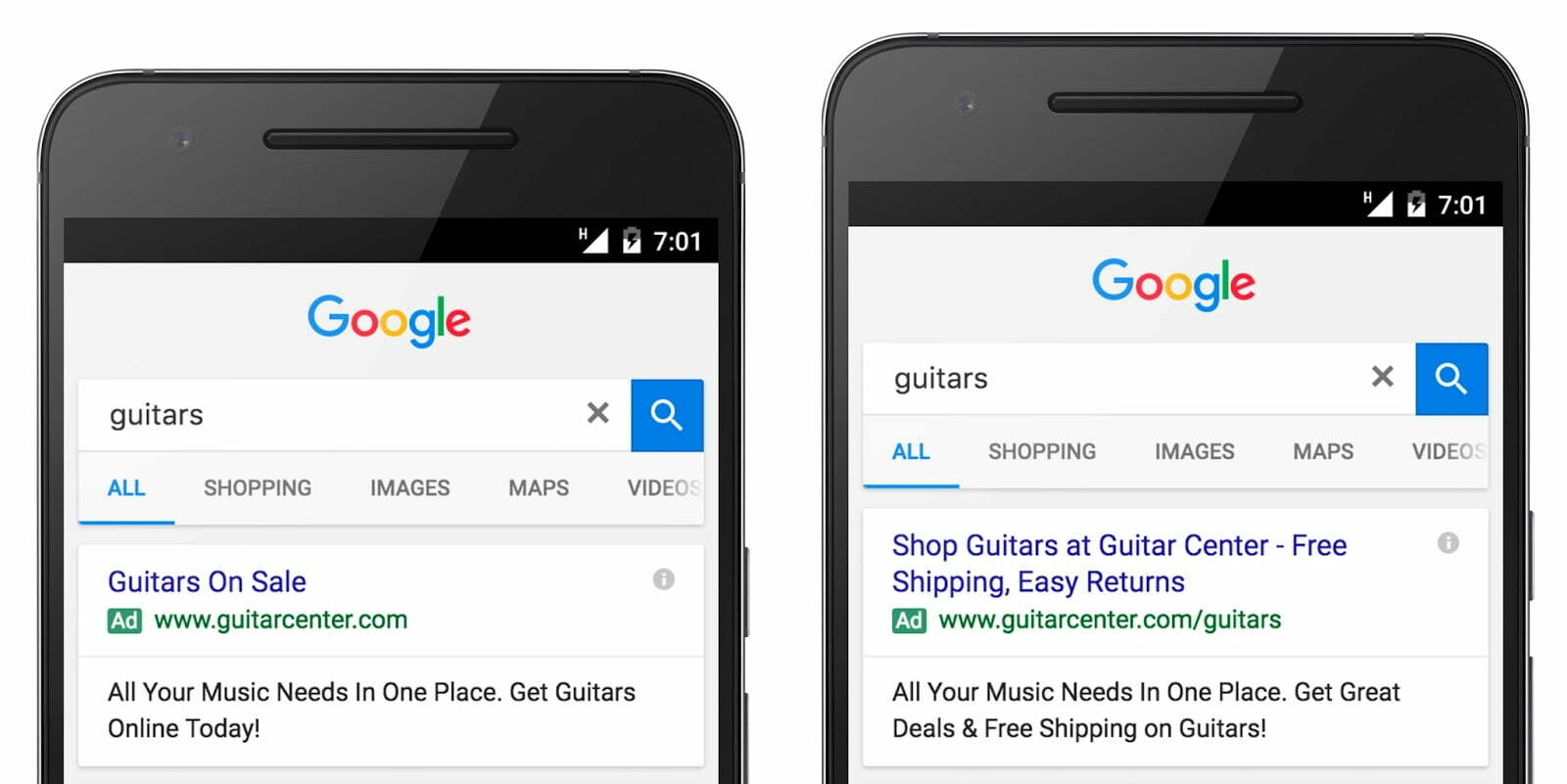

With the recent launch of landscape images available on the mobile results page, advertisers can now be more in control of how images appear, making it easier for them to get noticed and drive in more results.

Google also mentions the addition of Business Messages, where customers will be able to message brands through Search ads. With a 30-day response window, advertisers could create relationships with customers, before and after sales.

If you want to read more about what Google has to say about the latest Search On event, you can keep on reading here.

Google seems to be moving in a more direct and easy way of searching, leaving the infamous search box behind. This new mindset could especially help Shopping ads, but any advertisers that prefer a more visual approach will be intrigued by these potential innovations. We recommend all marketers try these out as soon as they roll out.

As always, we will let you know when Google announces these launches officially and we’ll keep an eye out for any new features coming your way. Stay tuned!

About Quantikal

Quantikal is a data-driven performance marketing agency based in Buenos Aires, Argentina. We help clients scale their business through profitable digital ad spending by constantly obsessing over clients’ key metrics. Quantikal’s experience working in diverse online companies in marketing roles including media buying allows us to provide solutions in the ever-demanding increase of marketing performance, doing more with less thus becoming a strategic partner.